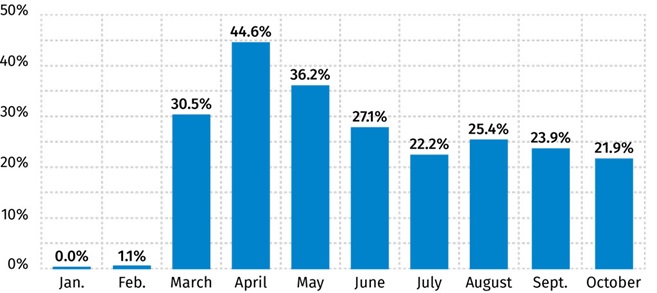

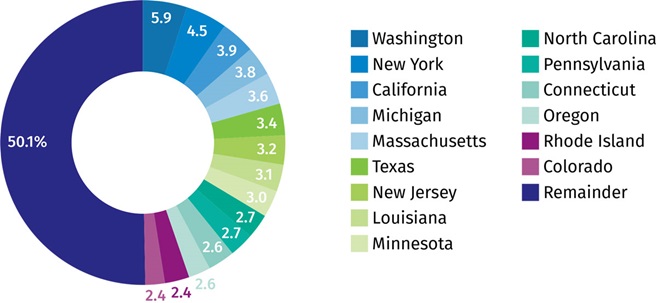

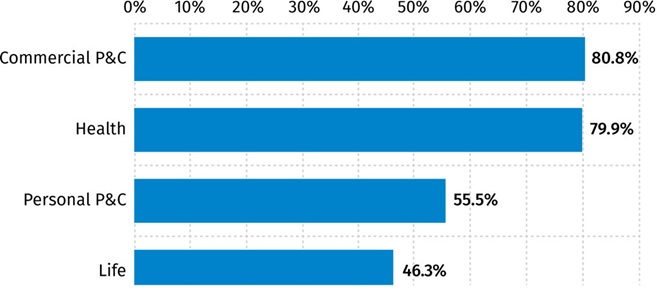

We have witnessed the creation of thousands of COVID-19-related regulatory updates in 2020. These charts are generated from our OneSumX® for Regulatory Change Management software that depicts the impact COVID-19 has had on the regulatory landscape.

COVID-19-related regulatory activity among U.S. Insurance companies fell 2 percent from September. Washington’s regulatory body is still ahead of all other state regulatory bodies for producing the most U.S. insurance COVID-19-related updates since January 1, 2020. Michigan’s regulatory body has surpassed those of Massachusetts and Texas by generating 3.8 percent of all U.S. insurance COVID-19-related updates since January 1, 2020. Commercial P&C and Health lines continue to be the most impacted by COVID-19-related updates and have risen 5.3 percent and 4.8 percent, respectively, since September 2020.

APAC Q4 Finance Risk and Regulatory Update Webinar 2020

Join our quarterly webinar and keep up to date with the latest research into the risk, finance, and regulatory issues impacting financial services professionals in APAC.

Ditch the Spreadsheets: Practical Advice for Automating your RCM Process

In this session, Elaine Duffus, Senior Specialized Consultant, and Steve Annino, Director of Solution Engineering, provide practical steps.

Individual retirement accounts

The deadline to complete a rollover of a qualified retirement plan (QRP) or individual retirement account (IRA) distribution is generally the 60th day after the date of distribution receipt.

Staffing for the future of internal audit

Internal auditors with a background in IT or data analytics are in high demand these days. But finding internal auditors with this type of skill set is hard, and retaining them is even more challenging.